Key Highlights this Week!

- Just HOW Costly is Cost of Issuance? – and why some issuers pay 500% more!

- NEW CA Report: Inconsistent Conduit Borrower Disclosure – with link to full report

- Want FREE CPE? Get 3 hours of dedicated Post Issuance Compliance training with CPE in November – see below for registration link and details!

- Next Steps Survey – look for it in your inbox tomorrow or Wednesday!

So…here goes…today’s Monday Muni Minutes!

Enjoy and have a great week! Deb

CURRENT EVENTS

How Costly is Cost of Issuance…Who Pays More – and Why?

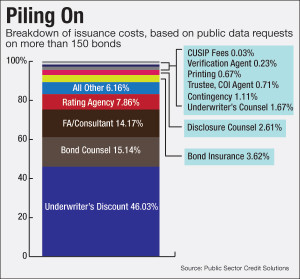

Marc Joffe of Public Sector Credit Solutions provided some fascinating details regarding transparency and variability in his recent report on cost of issuance. He demonstrates that, while some bond issuances may be remarkably similar in size, quality and term – that their costs to issue those bonds can vary by a staggering amount – some by more than 500%!

Seriously. 9.22% for one compared to 1.75% of par for another.

Joffe compared two bond issues for small school districts – one in CA and the other in MO.

Joffe based his report on official statements from more than 800 bond deals over the last four years.

Here’s what he found:

- Dehesa School District in CA paid $200,138 for $2.2 million in Bonds or 9.22%

- Cole County, MO paid only 1.75% for similar bonds in 2014

“The two bond issues were both offered in 2014 by small districts and have similar interest rates (for comparable maturities), so the bond and issuer characteristics don’t appear to justify the very large difference in issuance costs,” the report said. “Yet the Dehesa bonds were five times more expensive to issue than the Cole County bonds.”

Here are some more fun facts…

- Issuance costs average 1.02%, but as high as 10% for some CA issuers

- Lowest was .13% for an issue in Salt Lake City

- Highest was 10.62% for a special tax issue – Jurupa Unified School District in CA

- Four largest contributors are (in order):

- Underwriter discounts

- Legal

- FA fees

- Rating Agency fees

- Six of the seven issuers with the highest costs were CA school districts – all over 8.5%

Joffe explained, “All were small issuers selling less than $5 million in bonds, and all were new money bonds rather than refunding bonds.”

So, why are CA schools getting hit so hard?

According to the Bond Buyer article, Joffe explained, “There are a number of reasons” why California schools are paying so much.

He said, “Many districts get low ratings, and, in the absence of a state credit enhancement program (like the one available in Missouri) need to buy bond insurance to hold down their coupon rates. Others seem to be paying high financial advisor fees relative to elsewhere.”

In his interview with the Bond Buyer, Joffe made two clear points:

- “I wanted to bring the lack of transparency issue to people’s attention; if people in the market understood what other people are paying, it could make it more competitive and help bring the costs down,”

- “There is variation to the costs, within small deals and large deals. I think it is useful for issuers to be aware of this may require reforms at the state level or even shopping around for different financial advisor, lawyer or underwriter.”

Kudos Mr Joffe for sharing. Enough said.

[Editor’s Note: Marc shared some fascinating details on cost of issuance. What are your thoughts and experiences on this issue as it relates to your bonds?]

OUT & ABOUT

Conferences:

There are about 30 conferences and regional events for the second half of 2015…

You can go to this Bond Buyer link to review what’s coming up and register!

Resources:

Download NABL’s “Crafting Disclosure Policies” Report

IRS Interim Guidance on BABs and Other Direct-Pay Bonds

IRS 39-Page Memo TE/GE-04-0715-0019

See the full article in the August 3rd Edition of the Muni Minutes!

Replay: Webinar: MCDC – What Comes Next for Muni Underwriters

By: DIVER by Lumesis and hosted by the Bond Buyer

IT was AWESOME! In case you missed it…

Here is the replay link and the slides.

Check out the “muni deal of the week”…try if for FREE and look at it from the bondholder’s perspective.

On-Demand Post Issuance Compliance Training for Issuers

“Compliance Basics” – a FREE, 3-part video Compliance Framework training, plus the Monday Muni Minutes.

Just Released – with a valuable and amazingly cost-effective “team learning” option!

NEW In-Depth Training, PIC Essentials: The Audit-Proven Blueprint – covering, The IDR – Form 4564, Project Accounting Boot Camp and our hot-button friend, PBU!

On-Demand Webinar

Resource: On Demand Replay of Continuing Disclosure after MCDC

Slides: Final Slide Deck for Continuing Disclosure after MCDC

Muni Market Minute Updates

(Quick news bits on topics we’ve covered in earlier MMM editions!)

New CA Report Getting Attention:

Inconsistent Continuing Disclosure with its Conduit Borrowers

As continuing disclosure best practices (and the records and reporting associated with doing it effectively) is such a big topic here in the Muni Minutes, this was a must-share article!

The California Debt and Investment Advisory Commission issued a report titled A Preliminary Review of the Initial Disclosure Practices of California’s Conduit Borrowers which covered (in an academic tone) several key facets and criticisms regarding disclosure from conduit borrowers.

The report looks at the following seven factors:

- Did the conduit issuer address bondholder risks

- Focus on risk versus other topics

- Common inter-sector risks

- How different sectors addressed inter-sector risks

- Sector-specific risks

- The detail of those sector risks

- Change in the level of risk detail over time

I think the CA Treasurer’s Office had a great philosophy…

They said, “Our position is that the best defense to not disclosing adequately is to develop a clear, thoughtful process and to disclose as clearly as you are able to over multiple processes,” then further, “This office has a statutory mission to educate borrowers about how to do that.”

[Editor’s Note: I hope you find this downloadable report helpful – particularly if you have any conduit bonds in your portfolio. As a note, although all sectors were reviewed, the clear focus on this report was non-profit hospitals. Again, it just reiterates how important consistent disclosure is for our bondholders, potential investors and the regulatory agencies.]

Here are a few more notes, which may be of interest to you.

Due to high demand, we created PIC Basics as a free subscriber resource and then PIC Essentials – The Audit-Proven Blueprint to provide practical, hands-on tools you can use.

We have also spoken at local and regional seminars as well as conducted numerous virtual interactive conference sessions… and I promised you a Next Steps Survey…

Speaking of Next: Hey Deb, where IS that survey you talked about?

First, my apologies for not sending the survey last week as planned. I have been dealing with a very painful shoulder injury that pretty much derailed me until yesterday and I can only type for about 10 minutes at a time…(if you have any helpful advice on how to quickly resolve a frozen shoulder, I am all ears!)

So…needless to say, preparing the Muni Minutes or anything else is taking A LOT longer these days. There are so many cool things I wanted to share with you this week too. However, please be looking for the survey tomorrow or Wednesday – really.

Again, the Monday Muni Minutes is here to provide value to you, as the issuer.

The Monday Muni Minutes PIC Essentials Next Steps Survey should take less than 2 minutes to complete. Please fill it out as soon as you can this week – it will close on Friday. You can also e-mail me directly if you want to chat about things outside the survey.

Be watching for further details on survey results and “what’s next” in next week’s edition of the Monday Muni Minutes.

Remember: Take small bites. For more information or other resources, check out our Knowledge Library. You can also ask a question  in the comments section or reach out to us privately via e-mail and we’ll do our best to help.

in the comments section or reach out to us privately via e-mail and we’ll do our best to help.

You are welcome to download my nationally published AFP article, “A Taxing Dilemma.” In it, I share how we, as issuers, can systematically do a better job of understanding and managing our compliance programs. I think you will see strong similarities in what I experienced and what the IRS and SEC are focusing on…

Want FREE dedicated Post Issuance Compliance CPE?

If you or fellow issuer friends are going to be in the Phoenix, AZ area on November 16th, there will be a FREE 3 hour CPE-eligible post issuance compliance best practices training seminar – with a complimentary networking reception following the training! And yes, I will be one of the five expert guest panelists!

Here is the downloadable flyer and registration link!

We hope you found this week’s edition of the Monday Muni Minutes valuable and informative.

We really do look forward to your feedback – and to provide the best content possible.

Have a GREAT week!

In closing, we are so excited that PIC Essentials: the Audit-Proven Blueprint is now available! A special welcome to members who joined us. We look forward to your comments, questions and chatting with you in the Private Facebook Group – Club PIC!

NOTE: You can still join the learning group here: PIC Essentials: the Audit-Proven Blueprint.

Plus, as we believe so strongly in the team approach to success, we are offering a tremendous “team discount,” where you and four additional compliance members within your agency or company can join the series right along with you…for only $70 more!

We hope you found this week’s edition of the Monday Muni Minutes valuable and informative.

Chat soon!

As always, your comments are welcome…scroll down and let us know what you think about any of the articles!

To your compliance success,

Debbie

The greatest compliment you can pay us is to share this newsletter with your issuer friends….

P.S. Enjoy reading the Monday Muni Minutes each week? Invite your issuer friends to join us on Issuer 2 Issuer so they can get their free online training, PIC Basics! They will also get the Monday Muni Minutes delivered directly to their inbox as well as receive a special “new member” discount offer on the PIC Essentials training!

P.P.S. PIC Essentials: the Audit-Proven Blueprint is now available! You can sign up for the informative, on-demand webinar series by clicking above! Read about the “Team Discount” above! It’s truly a great deal.

P.P.S. Want a one-click way to get faster information? If you are on LinkedIn, you can get access to breaking muni news articles as well as interesting compliance tips and resources, posted by us during the week. Join our private LinkedIn Group Page, and follow us on our Company Page.