Last week highlights in today’s edition include Chicago’s pricey bond deal, Cook County’s Plans in the Wake, the HTF Stopgap as well as an Unusual “1st” in Pensions.

Check out the Link: MSRBs Annual Financial Report on Continuing Disclosure 2015!

Over the next several days, we will also be keeping an eye on Illinois as they continue talks about allowing Chapter 9, as well as the choppy budget talks in Florida.

So…here goes…today’s Monday Muni Minutes!

Enjoy and have a great week! Deb

CURRENT EVENTS

Wildly Oversubscribed – but Pricey – the Deal is Done…in Chicago

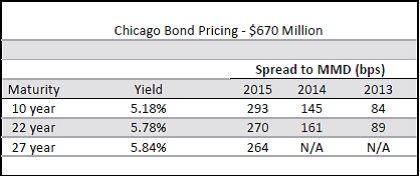

Wednesday was an expensive day for Chicago in the bond market, but they got the deal done…$670

million in bonds were refinanced with roughly $6 billion in orders.

Nearly 10x oversubscribed – bondholders are still betting on Chicago…

The muni community was watching where the spreads would fall, considering this was the first GO deal in a year by the City – who was still reeling from ratings downgrades into junk territory in the last two weeks.

Chicago’s new CFO, Carole Brown, was pleased with the results, saying “Investors remain confident in the city’s credit and a secure economic future for Chicago.”

Brown emphasized the overwhelming number of orders as a sign that Chicago is headed in the right direction. “Last month, Mayor Emanuel announced a financial plan that that would continue putting Chicago’s fiscal house in order- including addressing the city’s highly-leveraged legacy debt portfolio – and today we successfully executed one part of that strategy that will eliminate a substantial amount of taxpayer risk,” she said.

Here’s how the deals priced out…with comps and spreads to MMD:

These results clearly show that – no matter the obstacles – things can still get done.

When taking into account credit risk, Matt Fabian, a partner at Municipal Market Analytics said it well.

“Execution was the primary risk and the city needed all these deals done. This was a major step in addressing a potential drain on liquidity,” he said. “I think this shows that at these prices Chicago has exceptional market access. They got their market access but it came at a cost. These are very attractive rates for lenders.”

Other points to note in addition to Wednesday’s pricing:

- A $200 million line of credit from Morgan Stanley allows the City to take out the $130 million

that “fell outside” the original $800 million deal

that “fell outside” the original $800 million deal - The city is planning another deal in June for $112 million of sales tax bonds with a negative MTM swap of $30 million

- Bank risk still exists on $600 million of short-term borrowing, although there is a forbearance until September 30th

- There is also $110 million of swap termination risks on the city’s water system

- The sewer system faces repayments of $332 million in principal and swap termination fees of $25 million within less than six months, but negotiations are ongoing

Gold, Silver…or Asphalt?!? What’s in YOUR Pension Plan?

In the largest sale of an existing US asset, the bankrupt Indiana Toll Road has a new and atypical operator…Australian fund manager IFM Investors. The price tag? $5.72 billion.

At first blush, you might be thinking…so what’s the big deal?

Two words make this noteworthy – Pensions and Infrastructure.

IFM Investors is owned by 30 non-profit Australian pension funds – its investors include 70 US  pension funds, including the following notables:

pension funds, including the following notables:

- California Teacher’s Retirement System

- NY City Employee’s Retirement System

- the state board of Administration in Florida

- the Arizona State Retirement System

- The Illinois State Board of Investment

Secondly, this investment makes the first pension fund investment in US infrastructure – ever.

IFM bought the concession rights to the toll road after ITR Concession Company, who bought the original 75-year lease in 2006 for $3.8 billion, went bankrupt last September. Aggressive debt structure and revenue shortfalls were blamed for ITR’s demise.

The Indiana Finance Authority approved the new deal – which has 66 years remaining.

So, is this a sign of more things to come?

Indiana Gov. Mike Pence believes this is a solid decision.

“Roads mean jobs, and for that reason I applaud the Indiana Finance Authority for its work approving a new toll road operator,” he said in a statement. “This means better roads and rest stops for Hoosiers, and I am confident that IFM Investors has the experience and expertise to operate the toll road effectively.“

So…at the risk of sounding cheeky… Got Asphalt?

[Editor’s Note:This article…and the transaction itself, poses a novel and interesting option for both state and federal infrastructure woes…what do you think?]

TEB Advisory Panel to IRS: How Best to Do More with Less

A quick FYI…and report link for you to read…

The Advisory Committee on Tax Exempt and Government Entities (ACT), an external stakeholder  panel which advises the IRS on operational and policy matters, will be presenting reports to senior IRS executives on June 17th – on how to do more with less.

panel which advises the IRS on operational and policy matters, will be presenting reports to senior IRS executives on June 17th – on how to do more with less.

The IRS has suffered dramatic staffing reductions in the last several years.

Their report, titled “Doing More with Less – Balancing Resources and Needs,” is designed to help the agency which oversees the entire $3.6 trillion tax-advantaged bond market, as well as non-profits, pensions and compliance.

Check this Out! With the recent wave of municipal bankruptcies and some interesting details in the MSRBs Timing of Annual Financial Disclosures 2015 Report, released a couple of weeks ago, it sounds like municipal bond compliance enforcement will remain a key focus area.

[Editor’s Note: We will keep you posted as more details are available.]

OUT & ABOUT

Conferences:

The Bond Buyer’s Midwest Municipal Market Symposium

June 30, 2015 InterContinental Chicago Magnificent Mile, Chicago, IL

Resources:

Check out the “muni deal of the week”…and look at it from the bondholder’s perspective.

On-Demand Post Issuance Compliance Training for Issuers

“Compliance Basics” – a Free, 3-part video training, plus the Monday Muni Minutes

On-Demand Webinar

Resource: On Demand Replay of Continuing Disclosure after MCDC

Slides: Final Slide Deck for Continuing Disclosure after MCDC

MUNI MARKET MINUTE UPDATES

(Quick news bits on topics we’ve covered in earlier MMM editions!)

Here We Go Again…Short Term HTF Fix is Worrying to the States

While another two months of funding has been allocated to the ailing Highway Trust Fund (HTF), the states are not willing to take on the risk of moving ahead with projects in their states…to the tune of $1.3 billion in projects. The total could reach $2 billion in the next few weeks.

So, is this really a big deal?

Scott Bennett, director of Arkansas State Highway and Transportation Department shared, “We operate on a cash basis and are not willing to take risks,” he said. “We can’t assume that, since Congress has always fixed the federal HTF, at the last minute they will do so again.”

Arkansas has delayed 70 projects in their state alone.

Finding a long-term solution to the HTF has been elusive, as it would require an additional $100 billion of funding…just to keep it at current levels for the next six years.

So, what will Congress do? Here’s the thoughts…

“We will more than likely have to pass another short-term patch before the August recess and take steps to ensure the trust fund remains solvent,” Rep. Bill Shuster, R-Pa. said.

Maryland Transportation Secretary Peter Rahn is taking a longer-term view…

“They will do a short-term extension and I think they’re going to keep doing extensions until after the presidential election in November of 2016,” he said. “I think 2017 is when we will see something occur.”

[Editor’s Note: This news, although not unexpected, will not be helpful in addressing our long-term infrastructure problems – at the federal or state levels.]

Further Downgrades Near Chicago Possible – Cook County Focus

Cook County, Illinois – the home county to Chicago, could also be forced into the market and refinancing strain if further downgrades come in the wake of its largest city being lowered to junk status on May 12th.

Cook County also faces dramatic unfunded pension liabilities – which will not be easier to fix since the state’s Supreme Court ruling on “altering pension contracts.”

If the county is forced to refinance $500 million in debt, it could cost the taxpayers an additional $25  million per year in interest.

million per year in interest.

Chief Financial Officer Ivan Samstein is taking proactive steps.

“We have regular, constant dialogue with the ratings agencies, two of which have us on negative outlook,” he said. “And they have made it clear that absent structural comprehensive pension reform that’s constitutionally sound, there would be additional pressure on our ratings.”

The county has more than $3 billion in GO bonds, although their 13% of unhedged VRDBs is considered “very manageable.”

The proactive trigger in Samstein’s mind is 2 notches….

“We would look to act in advance of actually triggering to reduce the risk of bank renewal exposure,” said Samstein. “If our rating goes to A3 or A-minus, we’d look very seriously at fixing out our variable-rate debt to avoid the bank renewal risk.”

While there is no immediate plan to refinance, things could change.

“Chicago is half the county’s population and tax base, so what happens to Chicago affects us naturally speaking,” Samstein said. “But we’re not in the market and not planning to be in the market by the end of the year, so there’s no immediate impact.”

[Editor’s Note: This is another clear illustration of how interdependent city and county governments are on each other as well as on the overall financial health of the state…]

We hope you found this week’s edition of the Monday Muni Minutes valuable and informative.

As always, your comments are welcome…scroll down and let us know what you think about any of the articles!

To your compliance success,

Debbie

The greatest compliment you can pay us is to share this newsletter with your issuer friends….

P.S. Remember, invite your issuer friends to join us on Issuer 2 Issuer and to get their free online training, PIC Basics!

P.P.S Want a one-click way to get faster information? If you are on LinkedIn, you can get access to breaking muni news articles as well as interesting compliance tips and resources, posted by us during the week. Join our private Group Page, and follow us on our Company Page.