Wow – there is SO much cool news to choose from this week! To keep in the spirit of quick and pithy, we will focus on Q1 “Racing Stats”, Securitization – Yes or No?, and Small Banks Eying Muni Financing

So…here goes…today’s Monday Muni Minutes!

Enjoy and have a great week! Deb

CURRENT EVENTS

Who Won in Q1-15? Muni’s Best – Rankings, Stats and More…

As Issuers, we all know that it takes a great finance team to get a public bond offering done…it does not matter if it’s a small, simple “vanilla” fixed rate deal – it’s a ton of work with lots of moving parts.

Can I get a “you betcha” on that?

Even though 2014 started out sluggish in the muni world, it ended strong and appears to be continuing through Q1 2015 – largely due to refundings.

So, here’s how the “Racing Stats” lined out, compliments of data from Thomson Reuters.

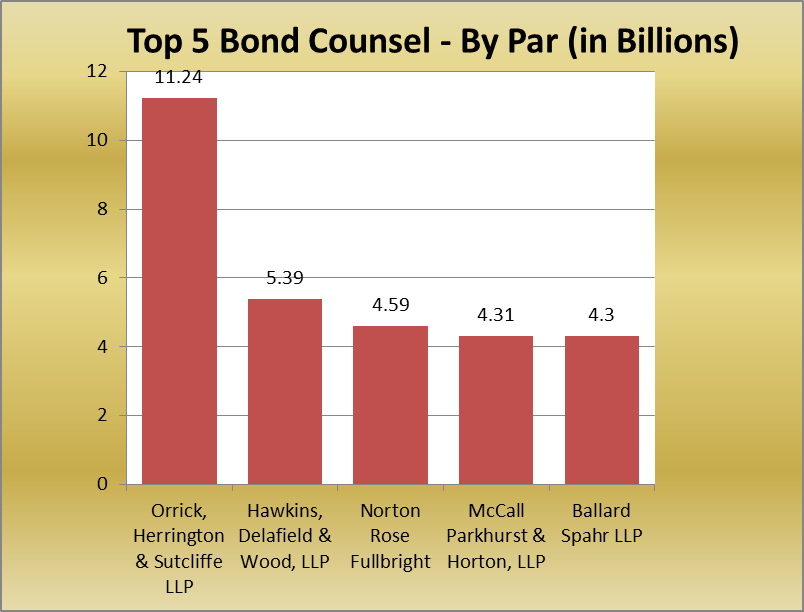

Bond Council: Orrick, Herrington & Sutcliffe ranked #1 with 73 deals for $11.24 billion.

The Top Five, with par in billions:

Here’s how the deals added up: Orrick @ 73, Hawkins @100, Norton @ 101, McCall @114 and Ballard @ 39.

Impressive Year-over-Year Stats: The Top 15 handled $102.383 billion of par value in 3,037 deals in Q-1-2015, up from $60.097 billion in 1,947 issues in Q1-2014.

Two of our champions had this to say about the market:

Ballard Spahr LLP: “As deals are becoming more complex, and with volume up from refundings, this is leading to more work for bond counsels,” said Bill Rhodes, partner and chair of the public finance department. “The bigger firms may have more horsepower to handle more work than a smaller firm, and can also pursue more work.”

Orrick: “We are always happy to maintain our market position,” said Roger Davis, Orrick’s chair of its public finance department. “The market is currently driven by refundings, but that will start to taper off. I am not confident the level of activity will sustain throughout the year.” Davis concluded with, “It almost been seven years since rates have been falling, we have a whole generation that has not seen a rising rates environment and that will be very interesting.”

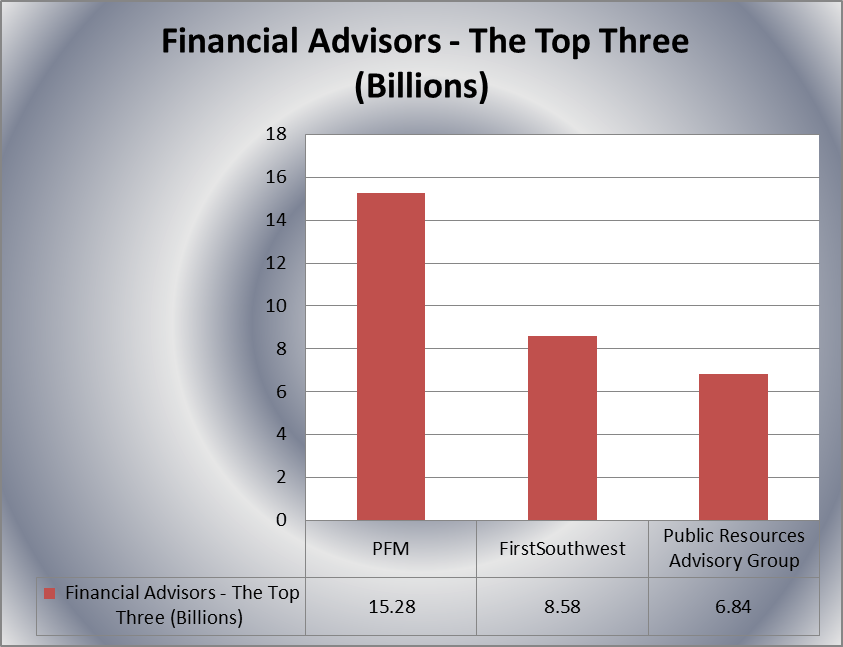

Financial Advisor: PFM – 235 Deals for $15.28 Billion – an Impressive 18.2% of the Market

What a great birthday present!

Last week, Public Financial Management celebrated 40-years as a financial and advisory firm, growing from 5 employees in Philly on April 11, 1975, to a 500 employee national leader in the municipal financial and investment advisory space.

John Bonow, CEO and managing director said, “As we begin our fifth decade, PFM continues to focus on helping clients overcome their financial challenges, access the capital markets on the best and most appropriate terms, invest resources wisely, and develop sustainable finances.”

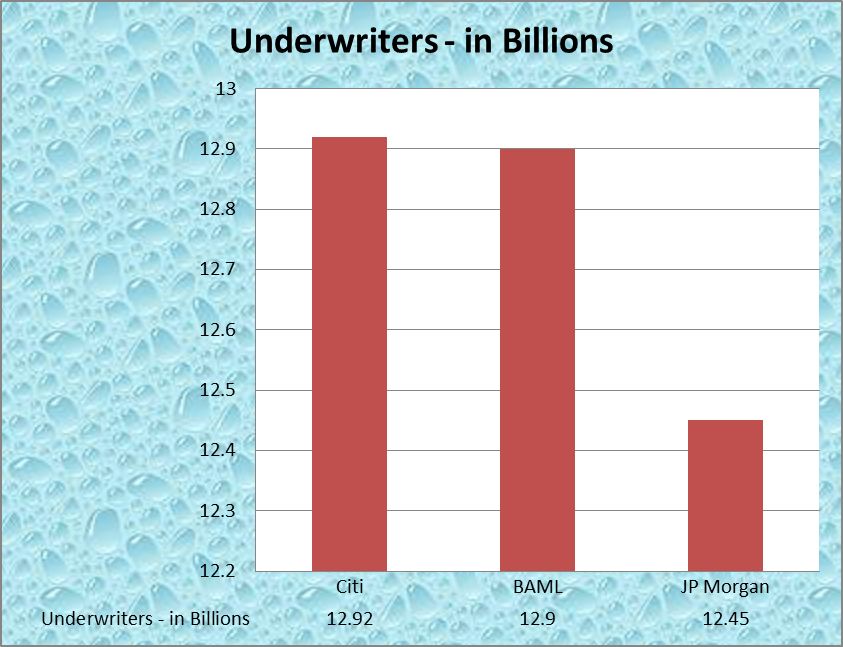

Underwriter: Citi claims Top Spot with 128 deals for $12.92 billion & 12.5%…

Jamison Feheley, head of banking, public finance at JP Morgan said “…we have benefited from increased new issue volume so far this year. Clients are still being cautious with new money projects, but we’re seeing refinancing business doing very well. Refundings are the primary reason why we’re seeing high volumes, as clients are taking advantage of the lower interest rate environment to achieve savings.”

A few more interesting UW notes:

Negotiated Underwriting: JP Morgan also nabbed the top slot with $10.52 billion for 12.8% market share

Competitive Underwriting: BAML scored highest here with $4.88 billion and 22.5% share

And in the closest and perhaps the most interesting race of all:

Co-Manager: Wells Fargo won the title…but it was a real squeaker. Wells edged out BAML, $3.966 billion to $3.760 billion, with Raymond James at $3.407 billion, Piper Jaffray with $3.348 billion and Morgan Stanley with $3.290 billion

[Editor’s Note: Yes, it does take an amazing finance team to make your bond deal work…and as we can see here, it’s working well. Very well indeed.]

What Do You Think About Securitization for Municipal Utilities?

If HB 617 and SB 1102 are passed in Florida, customers of the Florida Governmental Utility Authority might see a new line item on their utility bills in the near future…one that is irrevocable – to pay for debt service.

Called “cost containment bonds” for water and sewer projects, the debt service is financed using securitization. This allows a line item to be placed on the customer bill and the dedicated revenues are paid directly to the trustee for the related debt service.

And apparently one that makes the bonds attractive – like triple-A rating attractive. New York’s Long Island Authority uses it and Los Angeles Water and Power plans to as well, later this year.

So, is securitization a smart way to go or not?

Proponents are saying:

- Very effective, low-cost financing

- Protected by special laws

- Irrevocable charges are on customer bills – secure

Opponents are saying:

- Only one entity can use under the bill as written – monopoly

- Requires a “different skillset” as it is a sophisticated funding

- Customers can be charged, even if they do not use the service

- Oversight concerns as it could greatly increase borrowing capacity

While we wait to see what Florida decides, other utilities are also looking at securitization…

Duke Energy Florida is an investor owned utility, which is tasked with the decommissioning costs of the Crystal River nuclear plant…so they are looking to issue nuclear asset recovery bonds.

So…what do you think? Yes or No on Securitization?

[Editor’s Note: We will continue to follow this trend and keep you posted. In the meantime, I’d love to hear what your thoughts are…either way. Drop me an e-mail or a comment below.]

OUT & ABOUT

Conferences:

The Bond Buyer’s Midwest Municipal Market Symposium

June 30, 2015 InterContinental Chicago Magnificent Mile, Chicago, IL

Resources:

Have you had time to check this site out yet?

I am really enjoying the “new bond series” being featured each week –which provides insights into current public offerings around the country.

On-Demand Post Issuance Compliance Training for Issuers

“Compliance Basics” – a Free, 3-part video training, plus the Monday Muni Minutes

On-Demand Webinar

Resource: On Demand Replay of Continuing Disclosure after MCDC

Slides: Final Slide Deck for Continuing Disclosure after MCDC

Downloadable White Paper: Jargon Watch

Ever wonder what a Black Swan is or Break the Buck means? Find out here.

Muni Market Minute Updates

(Quick news bits on topics we’ve covered in earlier MMM editions!)

On The Road to a Solution? T-minus 42 Days and Counting…

As the clock keeps ticking, more bills are introduced attempting to address the looming May 31st deadline for the Highway Transportation Fund (HTF) to run out of money.

One bill focuses on raising the national gas tax, while the other is reaching offshore to repatriate $2 trillion in corporate earnings…the question is which one, if either, will be passed?

In these separate bills introduced last week, here’s what would happen:

- Gas Tax: House Proposal H.R. 1846 would raise the gas tax 66%

- 18.4 cents to 30 cents for gas and 24.4 cents to 40 cents for diesel

- Offshore Earnings Repatriation: S. 981 would tax voluntarily repatriated earnings at 6.50%

- Companies would have 5 years to bring back the profits, but must begin in year 1

There are a couple of key points to note – and one has teeth:

Both bills claim that their plan will provide a longer-term proposal to fix the HTF, although a bipartisan, bicameral transportation commission would be created to come up with a permanent and sustainable solution.

Watch out for these teeth: If the commission’s recommendation is not accepted within three years, there is a provision in the bill for an additional inflation-adjusted gas tax increase to be implemented.

Editor Note: [As shared several times in recent months, the reach and uncertainty of the HTF is already being felt across the states. Many are delaying or canceling roadwork as well as increasing their state gasoline tax. As taxpayers, we will likely see both hikes at the pumps in the very near future.]

Small Banks Eyeing Municipal Finance

While we are still digesting the Q1 stats above from the heavy hitters in the muni industry, the regional and community banks are quietly, but steadily making their mark in the tax-exempt financing arena as well.

Why?

Over the last five years, a growing number of issuers are moving away from the public offering arena due to the higher costs – and moving to loans with their neighborhood banker.

Community banks have long been stalwart friends of local governments, being a significant depository and treasury management partner for years. For the banks, this trend has been a real windfall.

And here’s a simple key you might not have thought about…

The banks have established relationships, the risk is seen as minimal and many are lining up to bring issuers onto the loan side of their balance sheets. It’s a win for the banks and a win for the issuers.

Just how big a player are the local banks? That’s a tough one…

Statistics on just how many issuers are using bank loans versus bonding is hard to find. While public bond deals are available nationally on EMMA, bank loans are not required to be similarly posted. They will likely be disclosed in state CAFRs.

The muni market is appealing to some banks to the extent that they have divisions dedicate to the municipal loan market – and several have recently hired experts to accelerate that growth.

[Editor’s Note: It should be noted that regional and community banks appear to be the strongest in loans that are in the $5 million range, not necessarily $100 million.]

In closing, we hope you found this week’s edition of the Monday Muni Minutes valuable and informative.

Hopefully most, if not all, of you are wrapping up Q1 accounting and financials…and that your Q1-15 continuing disclosure “to-do” list is progressing smoothly. Please feel free to reach out with any questions!

Chat soon!

As always, your comments are welcome…

To your compliance success,

Debbie

The greatest compliment you can pay us is to share this newsletter with your issuer friends….

P.S. Remember, invite your issuer friends to join us on Issuer 2 Issuer and to get their free online training, PIC Basics! Also, be watching for the re-release of “PIC Essentials” in the next two weeks.

P.P.S Want a one-click way to get faster information? If you are on LinkedIn, you can get access to breaking muni news articles as well as interesting compliance tips and resources, posted by us during the week. Join our private Group Page, and follow us on our Company Page.