In this Week’s Edition: We look at the SEC View and The Growing Trend toward GASB Standards, Yes or No on POBs, EMMA Disclosure shows Chicago Swaps are $400 MM Underwater, the Gas Tax Update and Just How Strong is Your Compliance Program?

CURRENT EVENTS

SEC’s Gallagher: Want Tax-Exempt Bonds? Adopt GASB Standards

At Tuesday’s a fixed income conference, SEC commission member Daniel Gallagher pressed his position regarding having municipal issuers all adhere to the same accounting standards.

issuers all adhere to the same accounting standards.

As a note, issuers can use FASB rather than adhere to GASB standards, but must use GASB in order to get a “clean audit” from their auditors.

According to the Bond Buyer article, one of his most outspoken concerns was not having all issuers adhere to the same standards. He is concerned as it relates to accounting for pension liabilities, which he believes could hide the “yawning chasm” in their balance sheets. He has repeatedly voiced his worry about the impact pension and OPEB liabilities have on an issuer’s financial strength.

Here is that pesky “P” word again.

Pensions and other post-employment benefit obligations have come to the forefront and will likely remain an item of intense scrutiny.

The SEC charged Kansas with understating their bond exposure to its pension liabilities, and absent consistent reporting standards, such exposure could be hard to quantify in a transparent and consistent fashion for many bondholders.

“According to the most recent information I could locate, just over two thirds of the 30,000 or so largest state and local municipal issuers use GASB standards,” Gallagher said.“Data were not available for the extent to which an additional 20,000 smaller municipal issuers use GASB standards, but I would hazard a guess that their rate of compliance with GASB is lower than the larger issuers.”

Pensions and other post-employment benefit obligations have come to the forefront and will likely remain an item of intense scrutiny.

“We need a legislative fix to mandate the use of GASB standards for municipal issuers, whether it is a grant of authority to the Commission to recognize GASB standards as they do the [Financial Accounting Standards Board’s] or as a condition placed on the bonds’ exempt status,” Gallagher continued. “This should help drive better transparency for investors in the muni market.”

[Editor’s Note: Pension and OPEB costs are woven into almost every financial distress situation we have covered in the last six months – absent embezzlement and fraud. Some of the numbers, particularly for those with guaranteed rates of return – are getting downright scary. Remember Chicago last week….$20 billion in unfunded liabilities. So, what happens to roads, current services and future infrastructure needs while those liabilities are being addressed?]

The number of soon-to-be-retired workers and abysmal returns over the last several years, quite frankly, are creating what could be “the perfect storm” for pensions. This next article provides a few thoughtful perspectives to consider…

Pension Obligation Bonds…Yes or No?

Kemp Lewis, senior managing director at Raymond James public finance in New York, provided the following commentary in last week’s Bond Buyer.

Mr Lewis first wants us to differentiate between what he calls a “True POB” and a “Faux POB”.

In a True POB, the issuer deposits the taxable POB proceeds into the pension program and then continues to make their current their ongoing pension obligation deposits.

In the Faux scenario, the proceeds are also deposited to the pension program, but then the issuer takes a vacation from making current pension payments. This second scenario does not improve the government’s pension funding position.

Lewis discusses the two following criticisms:

- POBs are a way for governments to create a leveraged, speculative investment

- If the government’s pension is not fully funded –they have a liability…or debt

- Pension rights have priority…and, in many cases, super-priority

- POBs are risky because they convert a soft liability into a hard liability

- As shown in both Stockton and Detroit, this is a fallacy

- Pension obligations hold up – even under bankruptcy

- Bondholders are taking note of this

Ouch…

He then talked about GASB accounting, which he suggests contain two aspects of pension liability accounting:

- A fixed income debt obligation equal to the unfunded liability at the government’s cost of capital

- The value of the government’s guaranteed rate of return on all investments in the fund as well as the actuarial assumptions

His contention is that the government will ultimately make the payment in full, with interest.

Lewis also brings up a little-discussed point: When looking at the accounting and actuarial determination of unfunded pension liabilities, it is possible and even likely that entities are paying less than the accruing interest – even when they are paying what the actuaries tell them to pay.

Is this so?

Lewis cites the “level percentage of payroll” amortization plan, which has upward sloping payments and negative amortization for sometimes up to 10 years. Creating hard liabilities via bonds where the costs are fully disclosed and transparent, does not change the entities’ overall liabilities – it just shifts which line it is on.

Lewis’s concluding statement is great. The best reason to create a visible, fixed repayment plan is to tackle the pension liability monster that is growing underneath the budget table of many state and local governments.

Well said. What do you think?

[Editor’s Note: As I have said many times in the past, the unfunded pensions and OPEBs are really scaring me. It looks to me like making the minimum required payment on your credit card…how long will it take you to pay it off? And what is the ultimate price you pay for that item…factoring in interest costs over time? The difference is credit card debt can often be discharged in personal bankruptcy. Pensions – however – are surviving Chapter 9’s…and surviving them rather well.]

OUT & ABOUT

Did you get a chance to check out Munivestor last week?

Looking from the Eyes of our Customer – our Bondholder

An Interesting Site: Focusing on Bond Investors & Solid Data Software

Resource: Munivestor.com

There are some really neat tools here – again, from the bondholder perspective. There are also some informative articles you can read…

On-Demand Webinar

Resource: On Demand Replay of Continuing Disclosure after MCDC

Slides: Final Slide Deck for Continuing Disclosure after MCDC

NEW: A Couple of Muni Market Minute Updates

(Quick news bits on topics we covered in earlier MMM editions…let me know what you think!)

Chicago Swaps – $400 million Underwater

I almost feel like Chicago should have its own weekly section in the Monday Muni Minutes. After last week’s good news about progress being made on its four swap termination events, this week’s Bond Buyer shared crystal clear detail on all of Chicago’s outstanding swaps – based on the city’s recent EMMA disclosure, which you can read here.

its four swap termination events, this week’s Bond Buyer shared crystal clear detail on all of Chicago’s outstanding swaps – based on the city’s recent EMMA disclosure, which you can read here.

In short, the city is nearly $400 million under water on 20 for swaps covering $2.4 billion of floating rate GO and revenue bonds.

This city’s $20 billion in unfunded pension liabilities was one of the key reasons for the rating agency downgrade, which triggered the swap termination events.

It should be noted that the extensive voluntary disclosure regarding the swaps was purely voluntary and his city was not obligated to provide such additional data. The additional information was filed as part of the city’s effort to improve bond investor relations – by providing better continuing disclosure.

Editor Note: The disclosure link provides valuable insights into what Chicago CFO Lois Scott is dealing with…not only from the swap termination risk perspective, but some of the significant events leading to this position.

Gas Tax Hike Less Painful…with Offsets

The proposed 10¢ per gallon Federal gas tax hike could be revenue neutral… if the tax increase is offset by a 2% reduction in the top marginal income tax rate.

The 54% increase is proposed to generate an additional $168 billion in revenue for the ailing Highway Trust Fund over 10 years. Other proposals on the table include doubling the current gas tax, a carbon-based tax as well as ways to tax corporate offshore earnings.

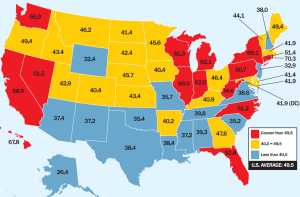

Other offsets being considered include lowering marginal capital gains rates, an increase in the standard deduction for both married and single filers, dropping the lowest tax rate to 9% or an  expansion of the earned income tax credit. This would be on top of the state gas tax as shown on the map here.

expansion of the earned income tax credit. This would be on top of the state gas tax as shown on the map here.

As shared in earlier MMM editions, both the Federal government as well as a vast majority of states are struggling to maintain their roads, bridges and other transportation infrastructure.

What do you think?

Editor Note: Roads and bridges are deteriorating. Several states have instituted gas tax increases in the last two years, and several more are looking at an increase in either 2015 or 2016. My auditor brain is still wondering if the terminology “revenue neutral” will equate to it being “cash outflow neutral” to each of us, as taxpayers. I would love to hear your comments on this.]

Editor Commentary: How Do You FEEL About the Strength of YOUR Compliance Program?

It’s hard to believe we have been producing the Monday Muni Minutes every week for 7 months now. Wow, so much has happened…the MCDC Initiative, the SEC and IRS’s continued focus on the municipal sector…and bondholder’s taking greater notice of our activities as well.

As I reflected this past week on how the Issuer 2 Issuer journey started, how we have grown and changed in such a short time as well as really thinking about the most valuable and logical next steps, I need to ask you the following question:

How do you FEEL about the strength of YOUR compliance program?

After all, Issuer 2 Issuer is not about me telling you all about my experiences, challenges and triumphs over the last 14 years in developing and defending several of our 40 audit-proof compliance protocols, so my organizations could maintain the tax advantaged status of their bonds…

Think about it…why would a fellow issuer embark on an endeavor such as Issuer 2 Issuer.com?

The bonds I was responsible for are good to go…so why do I feel compelled to teach post issuance compliance, instead of simply doing something fun and easy?

Because you have an unmet need…and, with the IRS and SEC honing in, that need is growing.

Issuer 2 Issuer is all about helping YOU – as a fellow issuer – make sure your post issuance compliance program is the best it can be – so you don’t have to worry about “what if our bonds don’t pass the audit?” or “we can’t provide adequate assurance to bond counsel for our refinancing.”

I lived that stress for several years…

…and it robbed me of family time, peace of mind and caused lots of headaches and long, long days at the office. I don’t want that to happen to you…and it doesn’t have to!

If you are one of the lucky issuers whose compliance binders have been managed all along, are completed, up to-date, and being actively monitored, then congratulations to you! What a relief it must be that you are free to spend your valuable time on activities other than worrying about your bonds.

However, if you know (deep in your heart) that your bonds and your agency are at risk because of the lack of strength in your post issuance compliance program, how are you feeling about that?

Then, part two of that question – what needs to change so you can focus your valuable time elsewhere…like other strategic projects, your family and just plain relaxing?

I think of post issuance compliance as a “3-D learning puzzle” rather than the “giant black hole” that I have heard some issuers call it. Although, truth be told, 14 years ago, tackling bond  compliance with virtually no knowledge WAS rather daunting, at first.

compliance with virtually no knowledge WAS rather daunting, at first.

Think about that. 14 years ago was 2001, right when issuers got the rude wake-up call that the IRS was going to be paying closer attention to their compliance.

Lucky me…

Over time, I realized the following:

- Effective bond compliance was my responsibility

- Starting early – before you get the questionnaire or notice…gives you the best chance of success

- Take the time to read your transcripts and know what your compliance obligations are

- From there, you can take it step by step – and it gets easier as you go along – really!

- Engage your bond and tax counsel too…they want you to be successful too.

Now, I can’t promise you that something (or even multiple things) strange and fuzzy isn’t/aren’t growing under your bond compliance rocks. However, I can tell you that I have lifted many of those same rocks, squealed real loud & ran…and then came back to deal with it…successfully.

Over my years as an issuer, with help from amazing bond & tax counsel, as well as weathering the storm of four IRS audits, I have learned what works, where to look for challenges and developed an audit-proven compliance blueprint…to guide me every step of the way. That is how I can help YOU.

So…how strong is your compliance program…right now? Are you where you need to be?

I cannot answer that for you – all I can do is let you know that audit-experienced, caring, issuer-focused help is available. It’s called Issuer 2 Issuer.com.

Again, these are your bonds; it’s your program…and ultimately your decision.

My heart’s desire is to help you – as a fellow issuer – not have a bad year if and when the IRS or SEC shows up…or when you are simply dealing with bond counsel and your underwriters during a financing or refunding – based on the new MCDC criteria for continuing disclosure.

We can help…see below for more information!

In closing, the free, 3-segment training from December, “Compliance Basics”, is now on YouTube as well as on the website for new members. You are welcome to share both links with your issuer friends so they can join us in the Issuer 2 Issuer community too.

All it takes is a quick two-line signup, a confirmation click and they will get instant access to training they can take from the comfort of their office. They will also get their own copy of the Monday Muni Minutes as part of their membership.

We have received multiple requests from current members for access to the free training too. If you would like to view the videos, you will find a private, current member’s link in your e-mail MMM access e-mail.

That link is unique to you, so please so not share it.

If you have trouble accessing the training, let me know and we will get another link to you right away.

2nd Update: PIC Essentials – the 10-Step Compliance Framework will soon be available as an evergreen, on-demand video series program. Regis is hard at work on that and it should be ready for registration before the end of the month. Stay tuned!

I even had the pleasure of making another intro video – yeah! I AM getting better at it…slowly!

We truly believe these issuer-focused, relevant and (hopefully) somewhat fun virtual trainings will help you improve your post issuance compliance programs – in a cost and time effective way.

After all, time is money, right?

We hope you found this week’s edition of the Monday Muni Minutes valuable and informative.

As always, your comments are welcome…

To your compliance success,

Debbie

The greatest compliment you can pay us is to share this newsletter with your issuer friends….

P.S. Remember, invite your issuer friends to join us here on Issuer 2 Issuer and to get their free online training, PIC Basics!

P.P.S Want a one-click way to get faster information? If you are on LinkedIn, you can get access to breaking muni news articles as well as interesting compliance tips and resources, posted by us during the week. Join our private Group Page, and follow us on our Company Page.