We hope you had a wonderful New Year. In this week’s edition, we’ll review what the SEC has planned for 2015, take a look at Special Districts and new Regs…

CURRENT EVENTS

2015 Promises to be Busy at the SEC

Yes, the SEC is promising to have another banner year for enforcement and regulatory oversight in 2015.

While still sifting through the issuer-submitted MCDC reports, the SEC has committed to increasing its enforcement action for the municipal sector as well as taking a closer look at public pensions.

Additionally, regional offices of the SEC have been taking on special sector projects of their own. Houston, for example, has recently been noted as placing a concerted emphasis on examining joint ventures in the oil and gas industry as well as paying particular attention to accounting fraud.

Per the SEC, in 2010 only 10 to 15 percent of the Fort Worth area dockets related to accounting fraud. Now, it’s closer to 30 percent. That is a 100+% increase in just four years.

Back at the federal level, a SEC spokeswoman said that in 2015 the agency will continue to work on implementing its Dodd-Frank and JOBS Act mandates, “including OTC derivatives, Regulation A-plus, ‘crowdfunding’ and executive compensation, and focus on rulemaking in other important areas, such as market structure and asset management.”

Bolstered by a $150 million budget increase for this year as a result of the continuing resolution passed just before the holidays, there will be many opportunities to enforcement and change will occur this year.

However, it still remains to be seen what impact, if any, the Congressional control change-of-hands will play going forward.

[Editor’s Note: I think 2015 will be an interesting year of enforcement, political battles and regulatory change for the municipal sector as well as for the equity markets.]

While Over at the IRS/Treasury….

IRS Regulations Helpful for Hospital Bonds, Lawyer says (B Buyer, December 31, 2014)

On December 29th, the IRS released final regulations, which clarified whether the new rules under the Patient Protection and Affordable Care Act would jeopardize the tax-exempt status of hospital bonds.

Under the Affordable Care Act, section 501(r) of the Internal Revenue Code was added. This section mandated that charitable non-profit hospitals adhere to certain requirements in order to maintain their tax-exempt status.

Two key requirements of Section 501(r) to note:

- The hospital needed to conduct a needs assessment at least once every three years and then adopt a strategy to meet those needs

- The hospital must have written policies in place regarding financial assistance for emergency care

Another particular area of concern was that hospital organizations (a system with more than one hospital) could jeopardize its tax-exempt status if only one of their facilities was not in compliance with the new regulations.

Talk about what can happen with one bad apple…

However, IRS has further clarified that if a single facility within a hospital organization is not in compliance, it will not jeopardize the 501(c)(3) status of the bonds for the entire organization. This is very helpful.

There is an interesting catch to the new regulation though…

Where a hospital organization operates multiple facilities and the IRS deems that one of those facilities is not in compliance, the organization will be taxed on the income that was derived from that non-compliant facility.

The importance of this clarification is that the tax imposed on the non-compliant facilities will not be deemed as unrelated trade or business of the organization. Under federal law, unrelated trade or business income is deemed to be private business use.

As we well know, excessive private business use could jeopardize the tax-exempt status of the bonds…of the entire hospital organization.

[Editor’s Note: This final regulation provides some much needed clarity. As shared in the MMM a few weeks ago, non-profit hospitals still face many uncertainties in implementing the ACA, adapting their pricing models and staying under the watchful eye of the rating agencies.]

Bond Tax Break Threat Recedes with Federal Deficit: Muni Credit (bloomberg.com., January 2, 2015).

As 2015 begins, it clearly appears that the century-old tax break for tax-exempt bond investors in the $3.6 trillion dollar municipal bond market will be safe…for at least the remaining next two years.

Since 2010, The Administration and Congress have looked at ways to lower the deficit as expenses kept increasing. The municipal bond tax break, which is expected to cost the US Treasury about $47 billion dollars in 2015, has been long targeted as one option to plug the deficit gap.

Governors and other local officials lobbied Congress to prevent any reduction in the municipal tax exemption. Simply stated, removing the exemption would have made municipal bonds more expensive and basically pushed the increased interest down to the local governments and taxpayers.

[Editor’s Note: 2015 could prove to be interesting for sure. With talk of corporate tax reform, ongoing Affordable Health Care Act implementation costs, 10,000 new enrollees on Medicare and Medicaid every day, combined with a louder clamor from Main Street to reduce the deficit…something has to give. What are your thoughts?]

OUT & ABOUT

Conferences in early 2015:

The Bond Buyer’s National Outlook 2015 Conference, January 27, 2015

Metropolitan Club, New York, NY

The Bond Buyer’s Texas Public Finance Conference, February 9-11, 2015

Omni Barton Creek Resort & Spa, Austin, TX

The Bond Buyer and BDA’s National Municipal Bond Summit March 1-3, 2015

The Westin Beach Resort & Spa, Fort Lauderdale, FL

Editor Commentary: OUCH! The California Controller’s Review of Special Districts…a Sign of Things to Come?

As we begin 2015 (and heave a sigh of relief that the MCDC is done…), a press release out of State Controller John Chiang’s Office late on December 30th really caught my attention:

Chiang’s office posted 50 million data points (don’t worry, only the high points are listed here) on the internal controls and operations of agencies called “special districts” in their state.

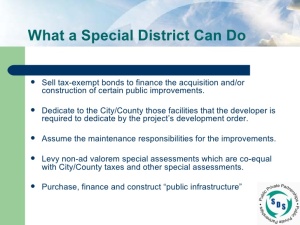

Special Districts can be formed for a wide variety of purposes…the most common are fire or other emergency service districts, water, sewer and public utility districts…as well as education, cultural or sports districts which provide benefit to the public.

The highlights of a few of these caused the hair on the back of my neck to stand up…and fast.

Three such special districts, Sierra Foothills Public Utility District (Madera County), the Indian Valley Community Services/Indian Valley Ambulance Service Authority (Plumas County) and the San Miguel Consolidated Fire Protection District (San Diego County) were specifically mentioned in the press release…with only one of them passing the test – the Fire District (with only 1 deficiency).

Both the PUD and Indian Valley were found delinquent in virtually all of the approximately 70+ internal controls tested for the 2010 to 2012 period as follows:.

Indian Valley Community Services District/Indian Valley Ambulance Service Authority delinquencies:

- Legally-required Financial Transactions Reports and Compensation Reports (FTRs) were consistently delinquent and/or remain outstanding.

- Property tax revenues received were understated by over $180,000

- Long-term debt (revenue bonds) of nearly $2 million was not reported

- Balance sheets did not reconcile to fund reports

- Lack of procedures and an outdated policy manual

- Established policies and procedures were not followed by the former General Manager

- Compensating controls were not practiced or were overridden

- Financial records for 2010-2012 were not available

In November 2013, the former General Manager was arrested in and charged with fraud, forgery, and embezzlement, initially totaling $381,841. In February 2014, embezzlement amount was increased to $676,375.

The Sierra Foothills Public Utilities District included the following deficiencies:

- Beginning with FY 2000-01, the district filed only four of 13 required FTRs

- Controls were nonexistent and no checks were in place to mitigate risks associated with lack of controls

- There were reporting issues for the district’s FTRs for FY 2010-11 and FY 2011-12

- The district did not have a policy and procedures manual

- The district could not provide any financial information and documents for the period under review

- The district has not had an independent audit since its formation

After publishing the telling reports, Chiang said, “While special districts can possess vast powers to tax, issue debt, and manage public resources, they are frequently the least understood and watched form of government. With so little public scrutiny and even poorer constituent participation, these little-known governmental agencies can become breeding grounds for scandal and shockingly poor fiscal management.”

He further stated, “With more than 4,800 of these agencies in existence today, there should be a renewed discussion about how these agencies can be formed, what checks-and-balances and reporting requirement should apply, and how they can be held accountable for their performance.”

Due to the severity of the deficiencies, follow up reviews of these districts will occur within one year.

[Editor’s note: In the recent aftermath of the Bell, CA fraud and continued financial stress on local municipalities, we should expect to see more emphasis at the State level on both post issuance compliance and internal controls related to possible embezzlement or mismanagement of funds…on top of continued SEC and IRS scrutiny.]

On the positive side, we are at the beginning of a brand new year…and can take steps to make sure this does not happen to any of us. What are your needs and how can we help you improve your compliance programs?

We hope you found this week’s edition of the Monday Muni Minutes valuable and informative.

As always your comments are welcome…

To your compliance success,

Debbie

The greatest compliment you can pay us is to share this newsletter with your issuer friends….

P.S. We hope you had a great New Year! Stay tuned, there will be some exciting news coming to your inbox in the next 48 hours…

P.P. S Want a one-click way to get faster information? If you are on LinkedIn, you can get access to breaking muni news articles as well as interesting compliance tips and resources, posted by us several times a week. Join our private Group Page, and follow us on our Company Page.